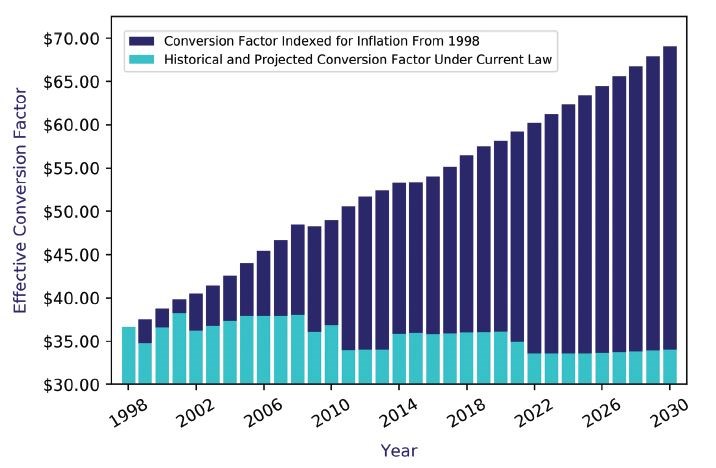

The conversion factor used to determine payment for physician services in 2021 is $34.8931. By comparison, in 1998 the rate was $36.6873 per unit of work. Over the same 23-year period, the rate of general inflation has increased by more than 50%. Thus, if the conversion factor had merely been indexed for general inflation starting in 1998, it now would be $59.68 (see Figure 1).16 It is important to note that the calculations in the figure are based on the rate of general inflation. The contrast would be even more dramatic if the conversion factor had kept pace with the rate of medical inflation.

Physicians and surgeons also routinely note that relations with commercial third-party payers have become increasingly burdensome, time-consuming for office staff (thereby increasing overhead costs), and unbalanced in relative bargaining power when contracting for services.17 Providers of all types of medical services consistently identify contracting and reimbursement as a constant struggle in their dealings with private payers.18

Lastly, there appears to be an ongoing attitudinal shift in the younger generation, who now comprise an increasing percentage of the medical workforce. Recent residency graduates increasingly opt for the perceived predictability of employment rather than seeking the entrepreneurial rewards of small business practice. Survey data on final-year residents from the AMA indicate that the top practice-setting preference for final-year residents was to be employed by a hospital, with 45% of respondents choosing this option. That figure has more than doubled from the 2008 iteration of the final-year resident survey, when 22% of respondents preferred hospital employment. Only two other practice settings registered responses that accounted for double-digit percentages; 20% of residents said they would prefer to work as a single-specialty medical group employee, and 16% indicated a preference for working at a multispecialty medical group. Only 2% indicated that their preferred practice setting was solo small business.19

Institutional Employment and Medical Liability Insurance

Institutional employers, whether university healthcare systems, other large healthcare institutions, or small community hospitals, typically provide hospital professional liability insurance for the physicians and surgeons they employ.20 Therefore, for employed physicians and surgeons, liability coverage is included as part of their employment, and the cost of their individual premium is hidden in the overall terms of compensation in their employment contract.

Many institutions and university and academic medical centers are self-insured.21 Many of these entities manage professional liability risk through a combination of self-insurance and commercial insurance coverage. The institution typically retains the risk for claims up to a specified per-occurrence “attachment point.” Commercial insurance coverage applies in excess of that amount and is generally subject to per-occurrence limits.22 Though corporate healthcare entities have found self-insuring the medical liability risk of their professional workforce to be financially sound, the pattern of layered coverage described earlier has not become a major threat to the traditional liability insurance industry.23 Both institutions and smaller liability insurance companies may purchase reinsurance to mitigate the risk of catastrophic losses above a certain payout level over a specified period.

Is Another Crisis in Medical Liability Premiums Imminent?

As more physicians and surgeons have moved toward employment over the past 20 years, one could postulate that a result might be a stabilization of the marketplace and a moderation of premium costs. Indeed, data from the MLM annual rate survey point to a temporal correlation between the preference for employment and the stabilization in liability premiums (see Table 1).1

The MLM conducts an annual survey of major liability insurers. The MLM collects data for its survey that represents companies comprising 65%–75% of the market. It is considered the most comprehensive source of data on medical liability insurance premiums available. The MLM reports manual premiums, which do not reflect credits, debits, dividends, or other factors that could affect the actual premiums that individual physicians pay for coverage. The manual premiums that insurers report to MLM are typically for policies with limits of $1 million per occurrence and $3 million per annum for all claims. Manual premiums are reported for internal medicine, general surgery, and obstetrics/gynecology for each state where the insurers surveyed provide coverage.9

The MLM does not provide summary information on premiums, such as averages or medians. Rather, it is primarily useful as an indicator of whether aggregate premiums have been changed in either an upward or downward direction and by how much.1

According to an AMA analysis of cumulative MLM data in 2020, for 7 of the previous 10 years, more than 60% of the medical liability premiums studied remained stable year over year. In addition, 6.85% of premiums were noted to have decreased in 2020 compared with 2019 when there was a reduction in 4.26% of premiums.

However, perhaps the most significant and striking finding in the 2020 data related to premium increases. Both in 2019 and 2020, the share of premiums that increased year to year reached highs not seen since the early 2000s. Specifically, in 2019 the percent showing some increase more than doubled to 27%, up from just more than 13% in 2018. Then in 2020, the percent of premiums increasing by some percentage rose again to 31.1% (see Table 1).1

Further, the 2020 data demonstrated a prolonged period of increase in the percentage of premiums that remained stable year to year beginning in 2013. This period of stability reached a zenith of 80.8% in 2018. However, the percent of premiums remaining stable then decreased in both 2019 and 2020 to 68.4% and 60.8%, respectively. This can be interpreted as indicating that premium stability was slowing.

Additionally, the 2020 MLM data also indicated that in 2019 and again in 2020, more than 25% reported an increase of the premium rates compared with the prior year. This was the first time such a high percentage of premiums had increased since 2005 and 2006.

Taken as a whole, the data from the 2020 MLM survey raised concerns that the market for medical liability insurance was poised for another hard market cycle.1 Assuming the data from the 2019 and 2020 MLM reports pointed to the beginning of another hard market period in liability premiums, it could then indicate that the move toward physician and surgeon employment had not precluded another crisis in premiums for medical liability coverage.

Why the Increase in Premiums in 2019 and 2020?

If the increased premiums documented in the data from 2019 and 2020 portend the beginning of another crisis, could a specific cause be identified and tracked, assuming the trend of premium increases continued into 2021?

In February 2020, the chief operating officer of The Doctors Company noted a rise in the average cost of liability claims and, specifically, an increase in the number of verdicts exceeding $25 million.21 One obvious effect of large damage awards is to take capital out of the industry, which then often results in higher prices for premium coverage. Another insurer similarly noted that the number of claims settling for more than $10 million has been rising steadily in the past decade. Sompo International noted that there were 38 such claims in 2019 compared with only 11 in 2010.24

Consistent with these findings, the MLM noted that a subset of insurers had been raising rates in the past few years and that 2020 represented the seventh straight year that the industry had suffered underwriting losses.9 It was asserted that because the increase in the number of high-dollar claims had not been matched by increases in premium prices, insurers were moving to correct the imbalance in a sort of “income statement-driven price correction.”21

However, an extensive study that examined the relationship between medical liability premiums and the medical liability system during previous crises demonstrated that damage awards played only a limited role in premium spikes that occurred in the early 2000s.25

The study examined the three crises in premiums that occurred in Illinois in the mid-1980s, the mid-1990s, and the early 2000s. The findings showed that paid claims rates rose sharply between 1980 and 1985. The paid claims then leveled off between 1986 and 1993, and then began a sustained period of decline. By 2010, claims were 75% lower than at the peak in 1991. Claims were lower despite the payout per claim increasing steadily over the same period. This adjustment was interpreted as evidence of the disappearance of small claims and those involving less severe injuries.

In summary, the study of statewide data indicated the total direct costs (awards to plaintiffs plus defense costs) attributable to medical liability litigation increased between 1980 and 1992, with a particularly dramatic increase in 1991. Total direct costs then declined steadily except for a modest increase between 2000 and 2002.25

Thus, of the three previous hard markets for liability premiums in Illinois, only the first crisis was temporally related to a major increase in liability claims payouts.25 This evidence indicates that should a new hard market be imminent, it should not be attributed to the recent increase in claims with payouts exceeding tens of millions of dollars, as some industry executives have suggested.

Premium Rates in the 2021 Survey: Would the Spike Continue?

As was noted earlier, the COVID-19 pandemic has had a profound impact on physician practice in numerous, substantive ways.5 The pandemic also cast a cloud of uncertainty over global financial markets and, therefore, secondarily on the medical liability insurance market. Because physicians, surgeons, and facilities were forced to cut back on healthcare delivery (routine wellness care, endoscopy services, and elective surgery), some insurers responded by offering premium discounts, rebates, and dividends.26 The potential impact of COVID-19, combined with findings from the MLM data in 2019 and 2020, led to much uncertainty and anticipation relative to the 2021 data.

Financial Status of the Medical Liability Industry

Findings in the 2021 MLM survey indicate that despite the raising of rates by a subset of insurers in recent years, the medical liability industry continued to experience underwriting losses for a seventh consecutive year. The 2021 report also noted that investment income had been significant enough to turn those underwriting losses into operating gains but that the industry was not showing any significant improvement in its key financial metrics.

The MLM compared current operating ratios to those preceding the last hard market in the late 1990s and made several observations. In 1998 and 1999, the average operating ratio for the medical liability industry was 91%, up from an average of 64% for the previous 5 years. From 2014 to 2018, the industry generated an average operating ratio of 81% followed by jumps to 89% and 92% in 2019 and 2020, respectively.

Regarding the impact of the stock market on the industry, the MLM noted the recovery that began in March 2020 resulted in a 3% surplus increase for the year, bringing the industry’s total surplus to $33 billion. During that same period, net written premiums totaled only $9 billion, resulting in the medical liability industry having the lowest net premium to surplus leverage ratio in the property-casualty insurance industry.9

Premium Rates in the 2021 Survey

The 2021 survey results show that the upward trajectory that started in 2019 continued in 2021. Overall, premiums increased in 2021 by approximately 1.7%. This finding was consistent with the pattern found in 2020 when the overall rate increase in premiums was 1.5%.9

Specifically, the 2021 MLM data reveal that 26.53% of the rates reported an increase by some amount—19.37% of reported rates increased 0.1%–9.9%, 6.32% increased 10%−24.9%, and 0.84% of rates increased more than 25%. It should be noted that 2021 was the third year in a row that more than 25% of reported rates increased—31.14% of rates increased in 2020 and 27.17% went up in 2019.9

However, perhaps more impactful in the stabilization evident in the overall pattern of rate movement is the percent of reported rates that remained flat in 2021 compared with the previous 2 years—69.13% of rates in 2021 remained flat versus 62.01% in 2020 and 67.75% in 2019. The 2021 report also noted that fewer reported rates decreased than in either of the 2 previous years—4.32% in 2021 versus 6.85% in 2020 and 5.1% in 2019.9 See Table 1 for a listing of the 10-year history of reported rate changes displayed by range band.

TABLE 1. HISTORY OF REPORTED RATE CHANGES BY RANGE BAND (2001–2021)