When reporting based on time, the ACS also requested clarification that the total time that the reporting practitioner spent on the day of the visit (including face-to-face and non-face-to-face time) should be used when selecting office or other outpatient E/M level. The CPT guidelines could be interpreted as the total time of both a physician and a qualified health professional for code selection. The ACS commented that the most straightforward and auditable method for using time to select the level of an E/M service is to require that the time reflect the total time of the reporting practitioner. CMS agreed with this interpretation of the guidelines by stating in the final rule “the billing practitioner’s total time.”

CMS also finalized proposals that increased the values of certain codes because CMS stated that these codes are analogous to crosswalks to the office and outpatient E/M codes that increased in value, including codes for the following:

- End-Stage Renal Disease Monthly Capitation Payment Services

- Transitional Care Management Services

- Maternity Care Services

- Assessment and Care Planning for Patients with Cognitive Impairment

- Initial Preventive Physical Examination

- Initial and Subsequent Annual Wellness Visit

- Emergency Department Visits

- Physical and Occupational Therapy Evaluations

- Behavioral Health Services

The increased values of these codes are partially responsible for the reduction in the CY 2021 conversion factor because of the budget neutrality requirements for Medicare Part B payment.

Global codes

In 2019, CMS accepted the AMA Specialty Society Relative Value Scale Update Committee’s (RUC)-recommended work relative value units (RVUs) for office/other outpatient E/Ms for CY 2021, which will increase the RVUs for these services, but the agency will not apply the same incremental increases to postoperative E/M visits that are bundled into 10- and 90-day global codes.

The ACS commented extensively on this proposed policy, expressing opposition to CMS’ failure to apply increases to standalone office/outpatient E/Ms to global codes. The College’s comments stressed that this policy will disrupt the relativity of the MPFS because it will increase payment for certain specialties but not for others that provide the same services. CMS’ policy will pay different specialties different amounts for the same work, which is prohibited by law.

In addition, the agency ignored recommendations from nearly all medical specialties when this policy was discussed at the RUC, which voted overwhelmingly to recommend that the full increase of work and physician time for standalone office/outpatient E/Ms be included in global codes. The College opposes any policies that unfairly result in lower reimbursement for surgeons and will continue its advocacy efforts to contest CMS’ failure to increase values for the E/M portion of 10- and 90-day global codes.

Telehealth and other services involving communications technology

Through a series of interim final rules making various regulatory changes to the Medicare program in response to the coronavirus 2019 (COVID-19) pandemic, CMS revised, on an interim basis, coverage and reimbursement policies for telehealth and other virtual services during the national COVID-19 public health emergency (PHE). In the CY 2021 MPFS final rule, the agency made permanent several of these provisional telehealth-related requirements first introduced to reduce COVID-19 exposure risks.

Continued payment for audio-only visits

In March 2020, CMS established separate payment for audio-only telephone E/M services, which previously were considered non-covered under the MPFS, and increased the reimbursement rates for such services to match those of in-person established patient office/outpatient E/M codes.

CMS finalized a policy that stated audio-only E/Ms will no longer be separately payable by Medicare at the conclusion of the COVID-19 PHE, and instead will be assigned a “bundled” status. Consequently, the cost associated with providing audio-only E/Ms will be bundled into payment for other incidental services.

Virtual presence of teaching physicians

CMS modified its teaching physician supervision and documentation policies during the PHE—and subsequently made such policies permanent in the CY 2021 MPFS final rule. Under the final rule, teaching physicians who meet CMS’ requirements may bill for services involving residents through interactive audio/video real-time communications technology, but only if the services are furnished by residents at training sites that are located outside of a designated metropolitan statistical area.

The agency clarified that when a teaching physician, through virtual presence, directly observes care rendered by a resident, the patient’s medical record must clearly reflect how and when the teaching physician was present for the service. For example, in the medical record, the teaching physician may document his or her physical or virtual presence at the training site during the key portion of a service, along with a notation describing the specific portion(s) of the service during which the teaching physician was present virtually.

In its comments on the proposed rule, the ACS opposed continued use of audio/video technology to provide direct supervision because of concerns about patient safety. For instance, in complex, high-risk, surgical, interventional, endoscopic, or anesthesia procedures, a patient’s health status can quickly change. The College stated that it is necessary for such services to be furnished or supervised in-person to allow for rapid on-site decision-making in the event of an adverse clinical situation. A supervising physician may not be able to recognize or meet these urgent clinical needs through audio/video interactive communications technology as well as for other services provided concurrently.

CMS acknowledged the ACS’ feedback and indicated that, for complex, high-risk procedures, the physical, in-person presence of the teaching physician is required during all key or critical portions of the procedure, and should immediately be available to furnish services during the entire service or procedure if necessary for patient safety given the risks associated with these services.

Electronic prescribing for controlled substances

The Substance Use Disorder Prevention that Promotes Opioid Recovery and Treatment (SUPPORT) for Patients and Communities Act of 2018 mandates electronic prescribing for controlled substances (EPCS) provided under Medicare Part D. In recognition of the time and resources practices must invest to comply with Drug Enforcement Agency guidance for EPCS, as well as additional challenges that the COVID-19 PHE presents, CMS delayed required practitioner compliance until January 1, 2022. The agency encourages prescribers to begin preparing for enforcement of EPCS requirements by integrating EPCS into their practices in 2021.

Conversion factor

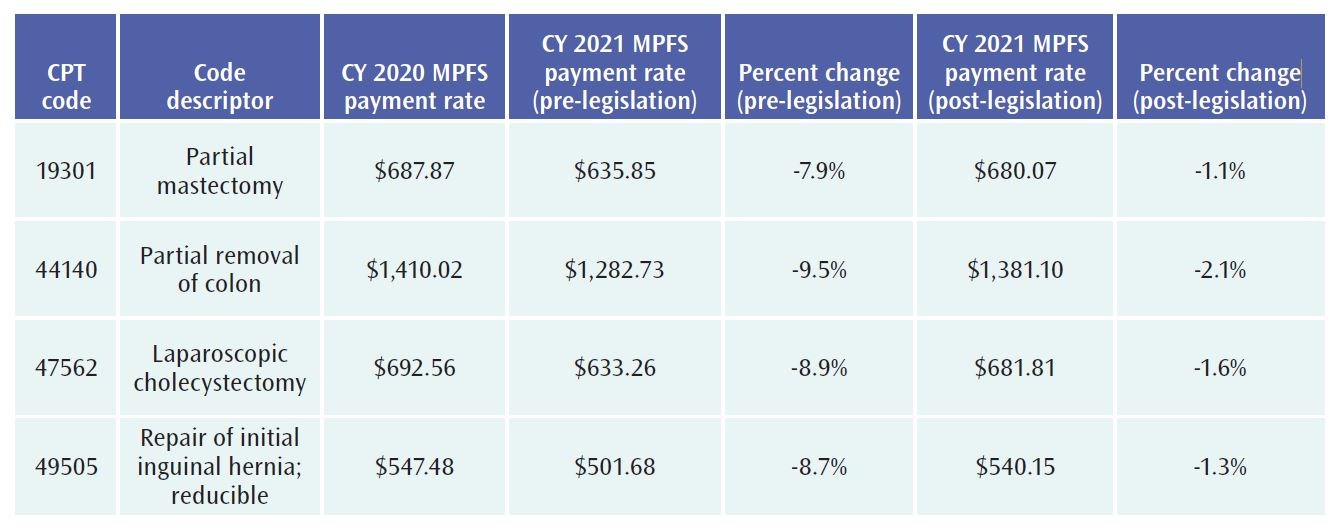

In addition to delaying payments for G2211 until 2024, the Consolidated Appropriations Act of 2021 reduced the 10.2 percent cut to the CY 2021 conversion factor (CF) that was initially finalized by CMS in the MPFS to a 3.3 percent cut. Through this legislative change, the CY 2021 MPFS CF is now approximately $34.890—a $1.20 reduction—from the 2020 MPFS CF of $36.09. The 2021 CF reflects a statutory update factor and a budget-neutral adjustment as set forth in section 1848 of the Social Security Act (see Table 2).§

TABLE 2. CALCULATION OF THE 2021 MPFS CONVERSION FACTOR POST-LEGISLATION